- Consulting with an expert and regularly monitoring the collectibles market are key strategies for making informed investments and maximizing returns.

- Ensuring proper insurance coverage and meticulous documentation is crucial for safeguarding the value of your collectibles investment.

- Regularly updating your insurance and appraisal of your collectibles can protect your investment against various risks and reflect their current market value.

- Including collectibles in your diversified portfolio can mitigate traditional investment volatility and potentially enhance overall returns.

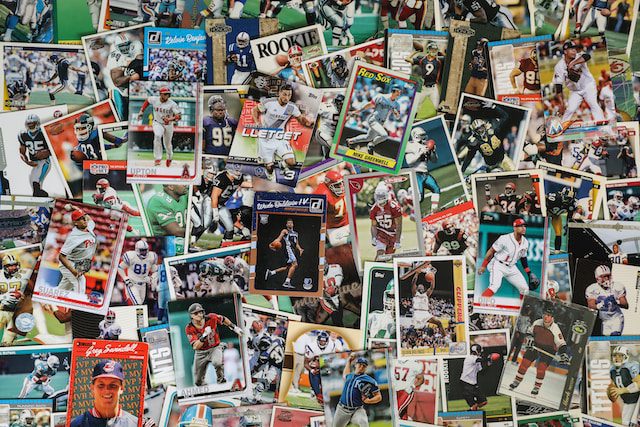

You’ve likely considered various traditional investment paths like stocks, bonds, or real estate. But have you ever thought about collectibles? Investing in collectibles, such as art, vintage cars, or rare coins, could be another viable avenue to grow wealth. This unusual strategy may seem daunting, but you could reap significant financial rewards with the right knowledge and approach.

Research Thoroughly

Before diving into collectible investments, you must have comprehensive knowledge about the market, the item of interest, and the potential risks. Here are some tips:

Verify Authenticity

The first step in investing in valuable collectibles, like gold coins, is to verify their authenticity. For instance, when looking for valuable gold coins for sale, it’s crucial not to be swayed solely by the seller’s claims. The market is awash with fakes, which can be convincing to an untrained eye.

Therefore, it’s wise to engage a professional appraiser or a certified numismatist to assess the coin’s authenticity. Their expert insights will provide the assurance you need regarding the coin’s actual worth and historical significance.

Remember, a real gold coin investment is not just about its face value; the historical significance and rarity factor can substantially boost its appeal and value to collectors. Always prioritize provenance and condition when making your selection.

Consult an Expert

Consulting with a collectible expert is a significant step in your investment journey. An expert can provide in-depth insights into industry trends, fair market value, and potential investment risks. This is essential because the collectibles market can be volatile and unpredictable, with values susceptible to sudden increases or decreases due to shifts in demand or trends.

For example, popular culture can significantly influence the value of a vintage car or artwork. A collectible expert can help you understand these dynamics and make informed decisions.

Their advice can help you avoid costly mistakes and maximize your investment returns. Seek an expert with a proven track record and a deep understanding of the type of collectible you’re interested in. This will ensure you receive accurate and relevant advice for your investment strategy.

Insure Your Collectibles

As you would insure your home, car, or other valuable assets, protecting your collectibles through appropriate insurance coverage is equally crucial. The specialized world of collectibles often requires specific insurance that goes above and beyond standard home or renters insurance policies.

These policies may not cover the full value of your collectibles or may exclude them altogether. Therefore, seeking a separate, specialized policy for your collectibles can be wise. An insurance policy tailored for collectibles will typically cover risks such as theft, damage, or loss, ensuring your investment is well-protected.

Moreover, remember to regularly update your insurance, as the value of collectibles can fluctuate over time. It’s essential to have your collection appraised regularly and to adjust your coverage accordingly. This way, you can ensure that your collectibles are adequately protected and valued at their current market price.

Keep Proper Documentation

Maintaining meticulous documentation is fundamental when investing in collectibles. This includes keeping all purchase receipts, provenance records, authentication certificates, and other related documents. These documents prove your ownership and the item’s authenticity, which is essential when selling or insuring your collectibles.

Keeping digital and physical copies of these documents for additional security is advisable. Moreover, documentation can also provide vital information about the item’s history and value. For instance, the record of previous ownership can significantly increase the value of a piece of art or a vintage car. Therefore, ensuring detailed, well-organized records can benefit your investment’s security and potential value in the long run.

Monitor the Market

Monitoring the market is an essential aspect of investing in collectibles. Given the volatile nature of this market, keeping a close eye on trends can help you make timely and profitable decisions. Regularly reading industry publications, attending auctions and trade shows, and following influential collectors and dealers on social media can provide useful insights into what’s hot and what’s not.

For instance, if there’s a growing interest in a particular artist, the price of their artwork may likely rise. Conversely, if a type of collectible falls out of favor, its value may depreciate. By staying in the loop with the market trends, you can better position yourself to buy low and sell high, maximizing your returns on investment. Remember, the key to a successful collectible investment is patience, knowledge, and a keen understanding of the market dynamics.

Diversify Your Portfolio

Diversifying your investment portfolio is vital in managing investment risk and achieving long-term financial goals. Including collectibles in your portfolio diversification strategy can offer you a hedge against traditional investment volatility.

Different types of collectibles, such as art, vintage cars, rare stamps, and coins, have unique market dynamics that can provide a buffer against conventional economic downturns. Collectibles often hold value and can even be appreciated during recessions, providing portfolio stability.

However, it’s essential to remember that investing in collectibles should complement, not dominate, your investment portfolio. They are long-term investments that require patience, research, and a passion for the items you’re investing in. Balancing your investment portfolio with a mix of traditional and alternative investments, such as collectibles, could enhance your overall returns and provide a more balanced investment portfolio.

Investing in collectibles offers an exciting, personal, and potentially profitable alternative to traditional investments. It requires thorough research, expert advice, market monitoring, and careful documentation. But remember, this journey should be fueled by a genuine passion for the collectibles you invest in. So why not start exploring this unique investment path today? Expand your financial horizons and dive into the world of collectibles.